Real Estate as a Wealth Indicator

When conducting prospect research, a fundraising professional may reference many different data points as wealth indicators of a prospect. Wealth points such as philanthropic giving, stock, and income are used when available. Research professionals often use real estate as a central data point to assess capacity, since it is very easy to identify (as discussed in this 2018 BWF article). This article will help establish a baseline for the new normal of the real estate market in the United States and how it affects the prospect research professional’s day-to-day.

Changing Home Prices

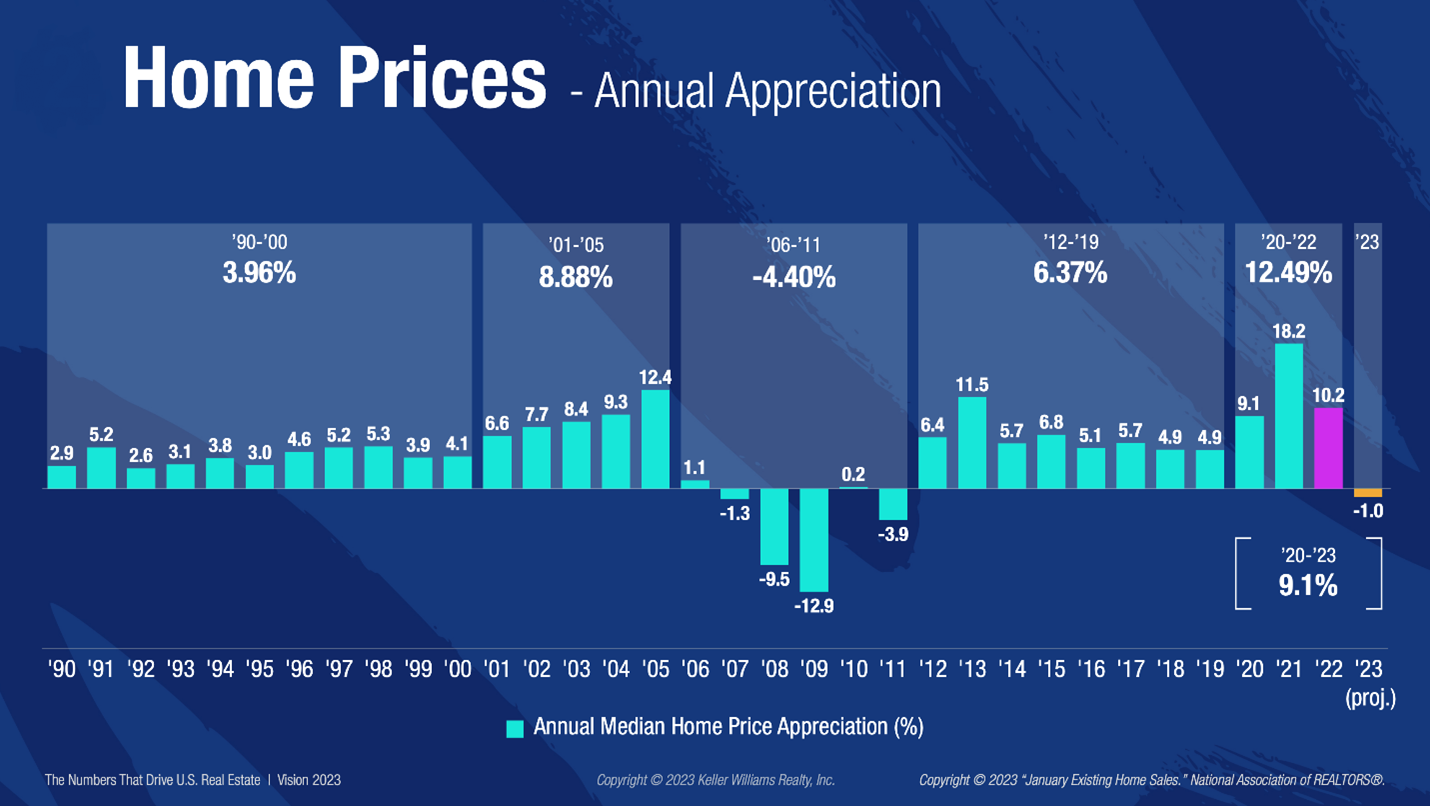

2023 is the year of getting back to normal in many areas of life, including real estate. According to real estate agent Robert Stewart of Keller Williams Select Realty, “We are in a return to normal after multiple years of double-digit inflation, which was not normal, and not sustainable.”

As a matter of fact, we have just lived through the second greatest run-up of real estate prices in recorded history, the first being during the years leading up to 2005. From 2020-2022, home prices increased by almost 12.5 percent. Research indicates that 2023 home prices are projected to hold almost steady, with a -1 percent decrease in home prices, as seen in the chart below from Keller Williams Realty, Inc.’s The Numbers That Drive U.S Real Estate.

Affordability

Another factor in the market and changing home prices is the affordability of re al estate. Since 1970, people have spent about 20.3 percent of their gross income on the principal and interest payment of their mortgages.

al estate. Since 1970, people have spent about 20.3 percent of their gross income on the principal and interest payment of their mortgages.

Because of the extremely low interest rates of the last 10 years, most families in the United States have spent between 13-17 percent of their gross income on their mortgage. As of 2022, however, that percentage has increased up to 24 percent. Even if this is a return to normal, prospects and donors may be feeling the pinch of this increase.

Pandemic Migration

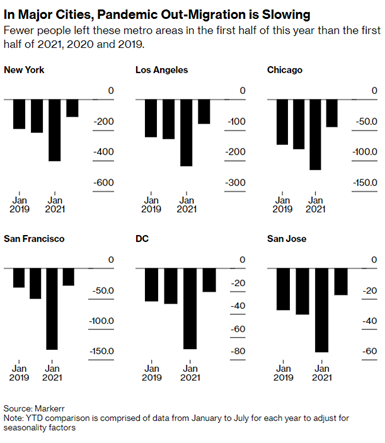

Coldwell Banker’s Global Luxury Report of 2022 reported that during the COVID-19 pandemic, there were mass migrations out of the city to suburban and rural areas, which have gradually settled into realigned lifestyles and values, which they refer to as “The Great Reconciliation.”

According to Adam Ozimek, the chief economist for the Economic Innovation Group, “Nearly 5 million Americans have moved since 2020 because of remote-work opportunities.”

As could be expected, the U.S. Postal Service’s change-of-address data showed that the metros with the biggest change in net-out migration were large, expensive metros where many people were able to work remotely, like San Francisco, New York, and Boston. The outward flow from cities has slowed a bit in 2022, however, as can be seen in the chart below.

Using Real Estate Data in Your Research

With so many changes in the last few years, some prospect development professionals are wary of using real estate values as a main indicator of wealth and a source for calculating giving capacity. However, using a tiered system like the one within the BWF single source rating methodology equalizes geographic differences in real estate markets, both residential and commercial, leading to a consistent, reliable, and transparent way of calculating giving capacity ratings.

In addition, using real estate data as one of many data points in your research will aid in providing a fuller picture of your prospect. If your organization needs guidance around prospect research, please contact Sarah Price.