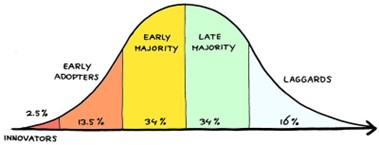

For the last several years, cryptocurrency, the blockchain, the metaverse, and Web3 have slowly moved along the adoption curve from innovators to early adopters and the early majority.

But, to date, Web3 and all its benefits and pitfalls have failed to cross the adoption “chasm” that would bring these new technologies to the point of mass adoption—particularly in philanthropy. (For more information about cryptocurrency, see our introductory blog post.)

Of course, there was the University of Puget Sound in 2014, which became the first institution to accept a gift of Bitcoin, and a simple Google search will see countless press releases from U.S. and Canadian institutions that are now accepting cryptocurrency among the other forms of making a gift. But with an estimated 180 million Bitcoin owners worldwide, the likelihood of a major Bitcoin donation for the vast majority of nonprofit organizations could be as low as the odds of winning the recent $1.33 billion Mega Millions jackpot.

This is where Decentralized Autonomous Organizations will stake their claim, and to which their proponents will make the case. According to the top result on Google, a “DAO, or Decentralized Autonomous Organization,” is a community-led entity with no central authority. It is fully autonomous and transparent: Its smart contract establishes the foundational rules, ensures agreed-upon decisions are executed, and at any point, proposals, voting, and even the very code itself can be publicly audited.

If you’re like me, that is a word salad of Web3 buzzwords that sort of makes sense but doesn’t quite hit home. A bit like looking at it through a kaleidoscope.

So, what exactly is a DAO? To me, it is the Web3 version of a giving circle: A group of people pool their funds together and, based on very clear rules and guidelines, decide how they want to distribute those funds. The impact of the collective is greater than that of their individual impacts, and the group has more leverage than if the individuals went to a nonprofit one at a time.

The advantage of using a DAO for philanthropy is that much of the management and logistics associated with running a giving circle are automatically managed by the technology underlying the community.

- Anyone with a compatible wallet and sufficient funds can “buy in” to the DAO. No need for a bookkeeper to manage the funds.

- It’s internet-based so your community of potential investors is global, not just your geographic- or affinity-based community like with a traditional giving circle.

- Selecting where funds go is automated, unbiased*, and transparent.

*Even the smartest of smart contracts are written by flesh and blood humans. And there are good intentioned humans and bad intentioned humans. - There are ample opportunities to build in stewardship and recognition directly into the DAO governance structure. Maybe everyone who contributes automatically receives tickets to a lecture from a leading faculty member on a particular topic or an NFT of the mascot.

The biggest caveat of DAOs for philanthropy is where this post started: DAOs are not yet mainstream. They have the power to revolutionize giving to the organizations we support and may lead to new ways of thinking about equity and impact in philanthropy. What is not yet clear is whether the “trustless” world that Web3 advocates espouse is the definition you find in the dictionary (“not deserving of trust”), or if it is the new definition that those advocates have created: “Trustlessness in the blockchain and crypto space simply means you do not need to place your sole trust in strangers, institutions, or third parties in order for a network or marketplace to function. Instead, trustless crypto systems rely on encrypted code and smart contracts to work and achieve (machine and/or social) consensus.”

What was once old is new again…and sometimes with a new definition.