Cryptocurrency is all the rage these days amongst Millennials and Gen Z. How do we incorporate this newly created wealth to increase support with our other daily fundraising activities?

Bitcoin, Ethereum, Chainlink, DAOs, the metaverse, and even a Dogecoin. The world of cryptocurrency can be overwhelming, to say the least. Thankfully we are starting to see some early adopters quite successfully navigate these digital waters and see true fundraising success. Higher than usual average donations, the elusive younger demographic, and a new donor acquisition tool to add to the arsenal are a preview of what is to come.

Crypto Defined

Cryptocurrency (or “crypto”) is a digital currency that can be used to buy goods and services and is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Currently, most governmental and financial systems are managed by a single authority, whereas most crypto is decentralized. This means there isn’t a single point of failure and that crypto is less likely to be hacked, and it can potentially be more democratic.

A blockchain is essentially a digital ledger of transactions.

HODLing is a crypto insider’s term for holding on to the asset (as in “holding on for dear life”), as crypto can be very volatile. (Frankenfield, Jake. “What Is Cryptocurrency?” Investopedia. Investopedia, December 7, 2021)

Where We Are

According to the Giving Block, one of the most popular crypto-giving platforms, 80 percent of cryptocurrency donations this year were from new donors to an organization. Most of those donors are from Gen Z and Millennial generations. The average gift of these younger donors is $10,500.

Donor-Advised Funds are also seeing a meteoric rise in crypto giving. According to Fidelity Charitable, they have received more than $272 million in cryptocurrency contributions in 2021. This is nearly quadruple its prior record in 2017. One-third of Millennial investors own cryptocurrency, and half are considering it for next year. Nearly half (45 percent) of cryptocurrency investors donated $1,000 or more to charity in 2020, compared to 33 percent of the general investor population. Fidelity has released its findings, which can be found here.

Tax incentives do play a large role when donating crypto. The act of donating cryptocurrency to a charity will not trigger a capital gain or loss and is considered tax-deductible. This is very attractive to current crypto owners as they convert their crypto to FIAT or another cryptocurrency, which is considered a fully taxable event. Donations above $4,999 do need to be officially appraised. This appraisal process typically costs a few hundred dollars. As these rules can always change, it is recommended to consult tax professionals for guidance.

Safety and Ethical Concerns

While cryptocurrency is a new and exciting technology, there are some legitimate concerns to be addressed. There is discussion around money laundering and a fear that crypto technology enables this type of behavior. While crypto is currently in its “wild west” phase and will need to be regulated, Bitcoin is used less for money laundering than cash, according to a report from Swift, a global provider for financial messaging services. When you take a deeper dive into how the blockchain is set up, you will notice every single transaction is recorded, publicly visible, and trackable. This lends to the notion that crypto can be more transparent than cash and cash equivalents.

Power consumption is also a legitimate concern. One Bitcoin transaction as currently constructed does consume about 1719.51 hours of electricity. There is no sugarcoating it. That is about 59 days’ worth of power consumed by the average U.S. adult household, according to CoinDesk. However, 62 percent of the mining facilities are powered by hydroelectric power, and the grand total of energy consumption coming from renewable energy is 39 percent. For comparison, the entire bitcoin ecosystem is said to use less than half of the energy banking systems require. Without going too far down the rabbit hole, this problem seems to be getting better due to the bitcoin halving and the fact that many alternative cryptocurrencies are making usage less electricity dependent.

Getting Started

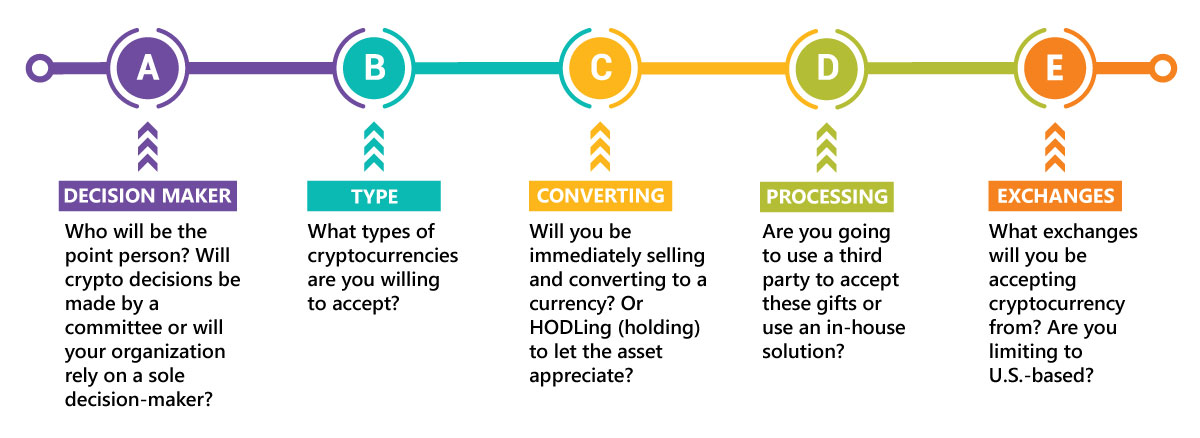

Determining your gift acceptance policy will be crucial for the success of your overall crypto-fundraising program. A formal written policy is a must when accepting gifts of cryptocurrency. There are a few questions that need to be asked:

- Who will be the point person? Will crypto decisions be made by a committee or will your organization rely on a sole decision-maker?

- What types of cryptocurrencies are you willing to accept?

- Will you be immediately selling and converting to a currency? Or HODLing (holding) to let the asset appreciate?

- Are you going to use a third party to accept these gifts or use an in-house solution?

- What exchanges will you be accepting cryptocurrency from? Are you limiting to U.S.-based?

These are just a few of the questions that need to be answered to guide decision-making. Be dynamic and flexible. Rules are constantly changing so it is important to stay up-to-date on new rules and regulations.

These are just a few of the questions that need to be answered to guide decision-making. Be dynamic and flexible. Rules are constantly changing so it is important to stay up-to-date on new rules and regulations.

To help navigate crypto-fundraising, third-party vendors are entering the scene to run nonprofit crypto wallets and handle the transaction process. This usually does involve an upfront monthly/yearly fee for the software and a percentage of the gift. Think of it like a payment provider that your website currently allows for gifts and can also take the next step of immediately selling the crypto.

Once you are up and running, the all-important marketing aspect comes into play. As crypto donors tend to be younger and less experienced with nonprofit fundraising, it is crucial to meet them where they are and market accordingly. Proper multichannel marketing can attract these elusive younger donors.

Putting It All Together

As it stands now, it looks like crypto is here to stay. With a significant amount of institutional money invested (the global market cap is $2.38 trillion, per CoinMarketCap as of this writing), it is unlikely crypto will quickly fade away. This isn’t to say that government regulation isn’t coming; 2022 will most likely see some changes within the U.S. crypto sphere and might change the dynamic a bit. Nonprofits would be wise to at least investigate this space and plan accordingly to meet their donors where they are.

Ready to Jump In?

If you are looking to develop a cryptocurrency donation strategic plan or are even just exploring the option, feel free to reach out via email. The BWF Digital team would love to have a conversation and can help walk you through all the steps necessary to get your program up and running, provide marketing expertise to ensure your program gets adequate attention, help with gift acceptance policies, recommend third-party vendors, and develop a successful strategy that will make your organization a crypto-fundraising player.